Cyber Insurance Market: Understanding the Dynamics

In the ever-evolving landscape of cybersecurity, businesses face increasingly sophisticated threats to their digital infrastructure. As a response, the demand for cyber insurance, also known as third-party cyber liability insurance, has surged in recent years. This article delves into the nuances of the Cyber Insurance Market, exploring its growth trajectory, market dynamics, research scope, applications, regional analysis, and key players shaping the industry.

Cyber Insurance Market Growth Analysis

Market Dynamics

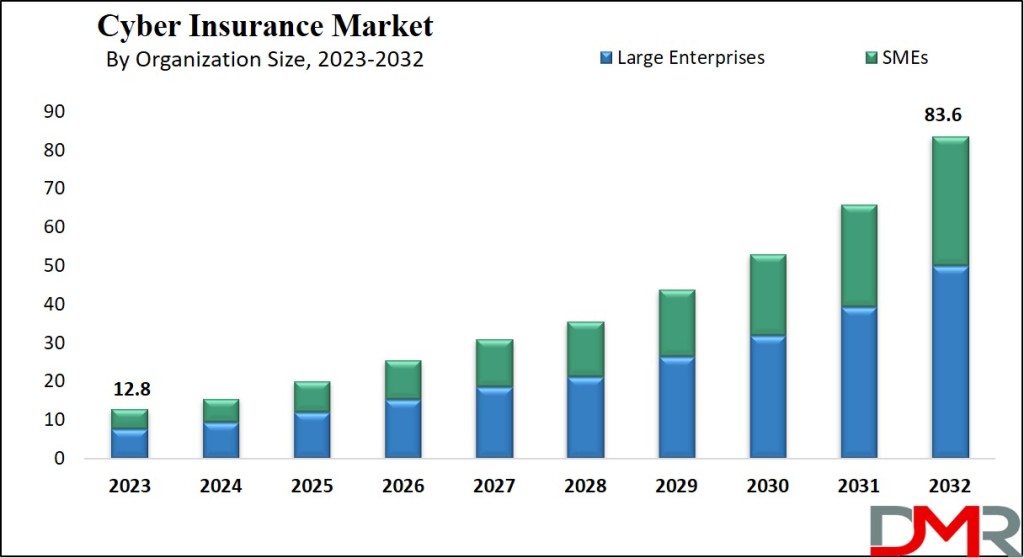

The Global Cyber Insurance Market is poised for exponential growth, with a projected value of USD 12.8 billion in 2023, expected to soar to USD 83.6 billion by 2032, boasting a remarkable CAGR of 23.2%. This surge can be attributed to various factors, including the pervasive availability of personal data online, the proliferation of social media usage, and the subsequent rise in cybercriminal activities.

Cyber insurance acts as a safeguard for businesses vulnerable to cyberattacks or data breaches, mitigating the financial fallout associated with such incidents. With a significant portion of the global population immersed in online platforms, the escalating frequency of cyber threats underscores the critical need for cyber insurance. Moreover, governmental and regulatory bodies have intensified efforts to bolster cybersecurity defenses, further propelling the demand for cyber insurance, spurred by stringent data privacy laws such as the European General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

However, the market grapples with challenges stemming from a dearth of expertise and technical knowledge, alongside mounting concerns surrounding cybersecurity and data privacy. The absence of an extensive historical record of cyber incidents exacerbates these challenges, necessitating concerted efforts to bridge knowledge gaps and fortify cybersecurity frameworks.

Get a Free PDF Sample Copy@ https://dimensionmarketresearch.com/report/cyber-insurance-market/request-sample

Key Takeaways:

- Growth Trajectory: The Cyber Insurance Market exhibits robust growth, driven by escalating cyber threats, increasing digitalization, and stringent data privacy regulations.

- Market Dynamics: Factors such as the easy availability of personal data online, the proliferation of social media usage, and governmental efforts to bolster cybersecurity defenses fuel the demand for cyber insurance.

- Segment Analysis: Large enterprises dominate the market, leveraging cyber insurance to fortify their cybersecurity posture, while SMEs turn to cyber insurance to mitigate financial losses resulting from cyberattacks.

- Application Insights: The BFSI sector emerges as a prime target for cyber insurance, given its handling of extensive monetary transactions, while the healthcare sector embraces cyber insurance amid its digital transformation.

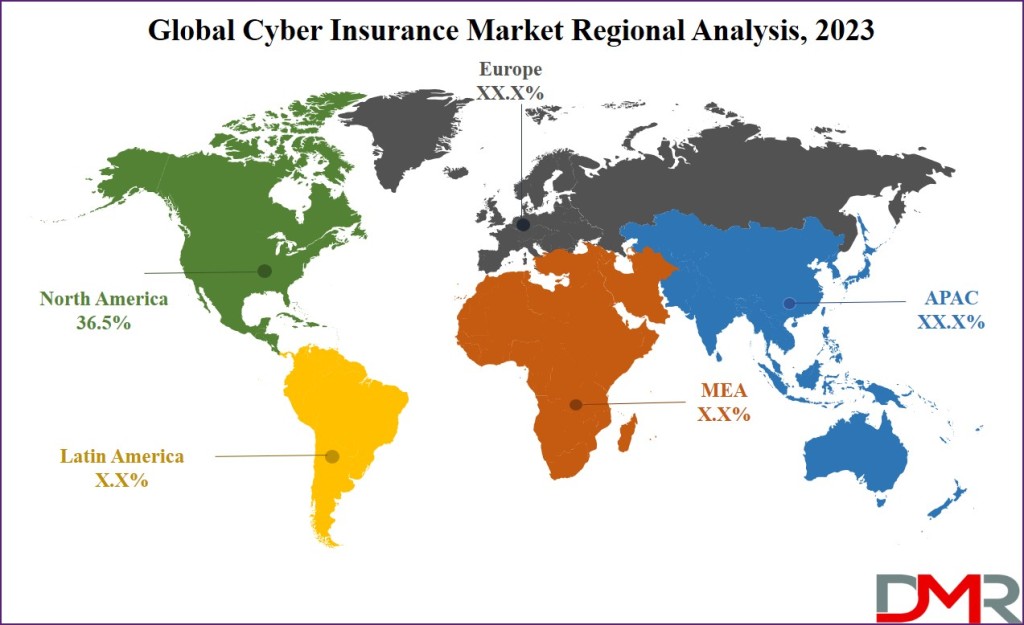

- Regional Trends: North America leads the market, propelled by industry giants and increasing awareness among SMEs, while the Asia Pacific region exhibits significant growth, driven by escalating cybercrimes and government prioritization of cybersecurity.

Regional Analysis

North America

In 2023, North America spearheaded the market, commanding a substantial revenue share of 36.5%. This dominance can be attributed to the presence of industry behemoths such as The Chubb Corporation and American International Group, Inc. Furthermore, increasing awareness of cyber insurance among small and medium-sized enterprises (SMEs) augments demand, fostering a conducive growth environment.

Asia Pacific

The Asia Pacific region is poised for remarkable growth, fueled by the escalating prevalence of cybercrimes in burgeoning economies such as Australia, India, and China. Governments across the region have prioritized cybersecurity initiatives, spurring demand for cyber insurance. Insurers are keenly eyeing opportunities to provide comprehensive coverage for cyber risks, further catalyzing cybersecurity strategies across diverse industries.

Buy This Report Here@ https://dimensionmarketresearch.com/checkout/cyber-insurance-market

Research Scope and Analysis

By Organization Size

In 2023, the large enterprise segment emerged as the dominant force in the market, a trend projected to persist throughout the forecast period. Large enterprises wield substantial financial resources to implement robust cybersecurity solutions and are fervently investing in cyber insurance policies to mitigate cyber risks effectively. Moreover, cyber insurance plays a pivotal role in augmenting computer security risk management within organizations, further bolstering the segment's growth trajectory.

Conversely, Small and Medium Enterprises (SMEs) face heightened susceptibility to cyberattacks due to their limited security infrastructure. Constantly navigating evolving threats, SMEs are increasingly turning to cyber insurance to safeguard their digital assets. Cyber insurance offers comprehensive protection, encompassing aspects such as business interruption, loss or damage to digital assets, online extortion, and theft of money, thus furnishing SMEs with a cost-effective risk mitigation strategy.

By Application

The Banking, Financial Services, and Insurance (BFSI) sector emerged as the dominant application segment in 2023, propelled by the sector's pivotal role in handling monetary transactions. Given the high-stakes nature of financial transactions, the BFSI sector constitutes a prime target for cyberattacks, ranging from extensive breaches to fraudulent activities. Consequently, financial institutions and government agencies are increasingly embracing cyber insurance solutions to fortify their cybersecurity posture and curtail escalating losses.

Moreover, the healthcare segment is poised for significant growth, fueled by the sector's digital transformation. While digitalization has rendered patient data more accessible, it has concurrently exposed vulnerabilities within the healthcare ecosystem. Sensitive healthcare information is a lucrative target for cybercriminals, necessitating proactive measures to fortify cybersecurity defenses. Cyber insurance emerges as a pragmatic solution, enabling healthcare organizations to offset potential losses and fortify their resilience against cyber threats.

Cyber Insurance Market Application Analysis

By Organization Size

- SMEs

- Large Enterprises

By Application

- BFSI

- Healthcare

- IT & Telecom

- Retail

- Others

Prominent Players in the Cyber Insurance Market

- AON Plc

- American International Group Inc

- Berkshire Hathaway Inc

- AXA XL

- Munich Re Group

- Zurich Insurance Co Ltd.

- Allianz Global Corporate & Specialty

- XL Group

- The Chubb Corp

- Insureon

- Other Key Players

Recent Developments in the Cyber Insurance Market (2023):

- Pricing Leveled Off: After a period of rapid increases driven by the rise of ransomware attacks, cyber insurance pricing saw a significant slowdown in 2023. As of Q2 2023, global pricing was only up 1% year-over-year compared to a 133% jump in late 2021.

- Continued Growth: Despite the pricing plateau, the cyber insurance market remains on track for significant growth. The global market is expected to reach USD 84.62 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 26.1%.

- Increased Scrutiny: While pricing has stabilized, insurers are implementing stricter underwriting practices and more complex application processes, requiring companies to demonstrate a strong cybersecurity posture to obtain coverage.

- Emerging Innovation: The first commercial transaction in the cyber insurance-linked securities (ILS) market took place in 2023, indicating potential for new risk-sharing solutions in the future.

Frequently Asked Questions (FAQs)

1. What is Cyber Insurance?

Cyber insurance, also known as third-party cyber liability insurance, shields businesses from the financial repercussions of cyberattacks or data breaches affecting their clients. It covers legal costs associated with cyber liability lawsuits, including fines and settlements.

2. What factors are driving the demand for Cyber Insurance?

The burgeoning availability of personal data online, the proliferation of social media usage, and stringent data privacy regulations are key drivers fueling the demand for cyber insurance. Additionally, escalating cyber threats underscore the critical need for robust cybersecurity measures.

3. Which sectors are prime targets for Cyber Insurance?

The Banking, Financial Services, and Insurance (BFSI) sector emerges as a prime target due to its handling of extensive monetary transactions. Moreover, the healthcare sector is increasingly embracing cyber insurance amid its digital transformation.

4. Why do Small and Medium Enterprises (SMEs) opt for Cyber Insurance?

SMEs face heightened susceptibility to cyber threats due to their limited security infrastructure. Cyber insurance offers comprehensive protection, safeguarding digital assets and mitigating financial losses resulting from cyberattacks.

5. What role does Cyber Insurance play in Risk Management?

Cyber insurance plays a pivotal role in risk management by fortifying organizations' cybersecurity posture. It enables businesses to offset potential losses, enhance resilience against cyber threats, and adhere to stringent data privacy regulations.

Conclusion

The Cyber Insurance Market emerges as a critical component in businesses' risk mitigation strategies amidst escalating cyber threats. With robust growth projected in the coming years, fueled by increasing digitalization and stringent data privacy regulations, cyber insurance stands poised to safeguard organizations against financial ramifications arising from cyberattacks. As industry players navigate evolving cyber threats, embracing comprehensive cyber insurance solutions is imperative to fortify resilience and ensure business continuity in an increasingly digitized world.

Comments (0)