Generative AI in Financial Services Market: Revolutionizing the Future of Finance

Introduction

In recent years, the financial services industry has witnessed a significant transformation, largely driven by technological advancements. Among these innovations, Generative Artificial Intelligence (AI) has emerged as a pivotal tool, revolutionizing various aspects of financial operations. This article delves into the dynamic landscape of the Generative AI in Financial Services Market, exploring its growth trajectory, market dynamics, scope, regional analysis, and the competitive landscape.

Market Overview

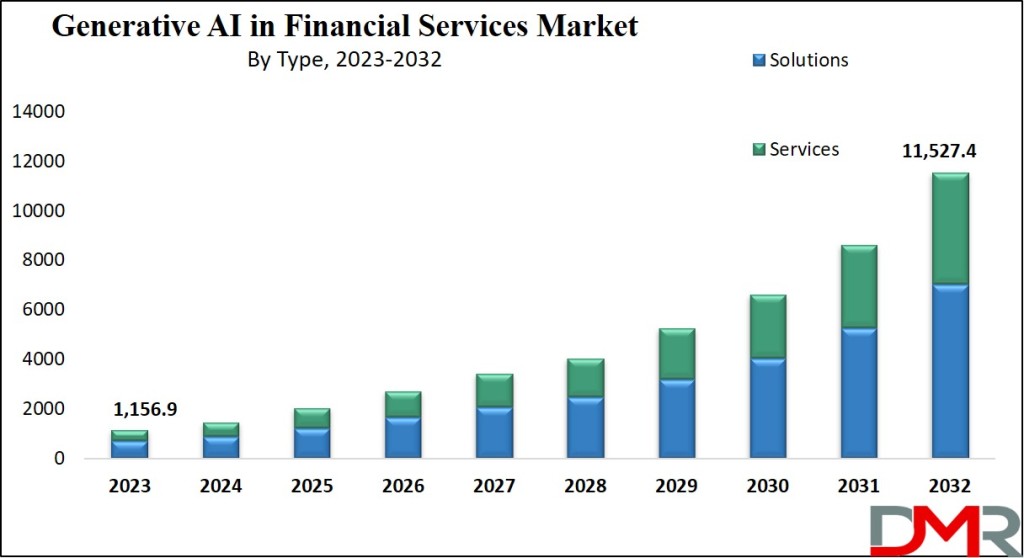

The Global Generative AI in Financial Services Market is poised for exponential growth, with forecasts projecting a remarkable trajectory. By 2023, the market is expected to reach a value of USD 1,156.9 million, and by 2032, it is anticipated to soar to a staggering USD 11,527.4 million, boasting a Compound Annual Growth Rate (CAGR) of 29.1%. This remarkable growth underscores the increasing significance of Generative AI in reshaping the financial services landscape.

Get a Free PDF Sample Copy Here@ https://dimensionmarketresearch.com/report/generative-ai-in-financial-services-market/request-sample/

Key Takeaways

- The Global Generative AI in Financial Services Market is poised for exponential growth, driven by increasing demand for accurate and efficient financial solutions.

- Generative AI plays a pivotal role in enhancing operational efficiency, risk management, fraud detection, and customer service within the financial services industry.

- Market dynamics are shaped by factors such as technological advancements, regulatory frameworks, and evolving consumer preferences.

- Strategic partnerships and alliances are instrumental in strengthening market presence and gaining a competitive edge in the rapidly evolving landscape of Generative AI in financial services.

Key Factors

- Technological advancements in AI and Big Data analytics drive market growth.

- Regulatory frameworks and trust issues pose challenges to widespread adoption.

- Strategic partnerships and alliances enhance market competitiveness and innovation.

Targeted Audience

- Financial institutions seeking to leverage AI-driven solutions for operational efficiency and risk management.

- Fintech companies aiming to enhance customer experiences and fraud detection capabilities.

- Investors and stakeholders interested in emerging trends and opportunities within the Generative AI in Financial Services Market.

Generative AI in Financial Services Market Growth Analysis

Market Dynamics

The rapid integration of Generative AI into financial applications stems from the pressing need for accurate and reliable services. Leading industry players such as IBM Corp, Microsoft Corp, and AWS have spearheaded this adoption, investing significantly in Research and Development (R&D) to bolster their capabilities and expand their market influence. Generative AI offers unparalleled advantages, including quick analysis of vast datasets, facilitating pattern identification and informed decision-making. This technology plays a pivotal role in diverse financial operations, including fraud detection, risk assessment, investment forecasting, and customer service enhancement.

However, despite its promising prospects, the growth of Generative AI in financial services faces several challenges. Chief among these challenges is the inherent uncertainty surrounding AI-driven decision-making, particularly in critical domains such as risk assessment and fraud detection. Moreover, the complexity of AI algorithms poses decoding challenges, with inadequately designed or tested algorithms risking biased outcomes. Additionally, the high implementation costs and evolving regulatory frameworks further complicate the landscape, posing barriers to widespread adoption, particularly for small-scale financial institutions.

Research Scope and Analysis

By Type

The Generative AI Financial Services market is characterized by two distinct segments: solutions and services. In 2023, solutions emerged as the dominant category, contributing significantly to overall market revenue. These solutions encompass software tools facilitating AI-powered banking solutions, capable of extracting accurate and comprehensive data from large datasets. Conversely, the services segment is poised for rapid growth, driven by its efficacy in managing AI-enabled Fintech applications.

By Deployment

The market segmentation based on deployment mode comprises two major segments: cloud and on-premise. In 2023, on-premise deployment emerged as the most lucrative, owing to its historical data retention capabilities within the confines of financial institutions' systems. This mode of deployment leverages AI algorithms to analyze historical data trends, offering valuable insights and recommendations. The integration of cloud computing and AI augments productivity, efficiency, and data security, mitigating human errors in data processing.

Generative AI in Financial Services Market Deployment Analysis

By Application

The application-centric segmentation of the Generative AI financial services market encompasses distinct segments, including credit scoring, fraud detection, risk management, forecasting and reporting, among others. Notably, forecasting and reporting emerge as the primary growth drivers, underpinned by factors such as operational efficiency enhancement, data-informed decision-making, and revenue generation. The synergy of business analytics, AI, and Big Data is poised to revolutionize decision-making processes, particularly within the burgeoning fintech sector.

The Global Generative AI in Financial Services Market Report Segmentation

The comprehensive segmentation of the Global Generative AI in Financial Services Market encompasses various parameters, including type, deployment, and application, providing valuable insights into market dynamics and trends. By type, the market is bifurcated into solutions and services, while deployment modes include on-premises and cloud-based solutions. Application segments include fraud detection, credit scoring, forecasting and reporting, risk management, and others.

Buy this exclusive report here@ https://dimensionmarketresearch.com/checkout/generative-ai-in-financial-services-market/

Regional Analysis

North America

North America dominates the global Generative AI in Financial Services Market, commanding approximately 39.8% of total revenue in 2023. This dominance is attributed to robust R&D initiatives and advancements in well-developed economies such as the United States and Canada. These nations exhibit rapid adoption of AI technology in financial services, bolstered by a thriving ecosystem of established players, startups, and emerging enterprises.

Asia Pacific

The Asia Pacific region is poised for significant growth in the Generative AI in Financial Services Market, driven by the rapid adoption of digital payment systems and internet-based services. Countries across the region are witnessing a surge in fintech innovation, fueled by favorable regulatory environments and increasing consumer demand for tech-driven financial solutions.

Generative AI in Financial Services Market Regional Analysis

The regional analysis provides valuable insights into market dynamics and growth prospects across key regions worldwide. Regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa exhibit distinct market trends and growth drivers, shaping the global landscape of Generative AI in financial services.

Competitive Landscape

The competitive landscape of the Generative AI in Financial Services Market is characterized by intense competition, driven by the quest for enhanced financial processes, cost efficiency, and superior customer experiences. Market players are increasingly forming strategic partnerships and alliances to strengthen their market presence and gain a competitive edge. For instance, Virgin Money's partnership with SurePay exemplifies collaborative efforts to enhance consumer protection against online fraud, underscoring the industry's commitment to innovation and security.

Prominent Players in the Global Generative AI in Financial Services Market

Key players in the Generative AI in Financial Services Market include industry giants such as IBM Corp, Intel Corp, Amazon Web Services Inc, Microsoft Corp, Google LLC, Salesforce Inc, Narrative Science, among others. These players are at the forefront of driving innovation and shaping the future of financial services through advanced AI technologies.

Conclusion

The Generative AI in Financial Services Market represents a transformative force reshaping the financial services landscape, with profound implications for operational efficiency, risk management, and customer experiences. Despite inherent challenges, including regulatory complexities and trust issues, the market is poised for exponential growth, driven by the increasing adoption of AI-driven solutions across diverse financial applications. As technology continues to evolve, market players must embrace innovation and collaboration to capitalize on emerging opportunities and navigate the evolving competitive landscape successfully.

Discover our reports on leading platforms.

Edge Computing Market on Globenewswire

Comments (0)