Mobile Payment Technology Market: Shaping the Future of Financial Transactions

The Mobile Payment Technology Market is witnessing a remarkable surge, driven by the proliferation of smartphones and the growing preference for convenient and secure payment methods. With the advent of various mobile payment solutions, consumers are increasingly relying on their mobile devices for financial transactions, revolutionizing the way we pay for goods and services. This article delves into the dynamic landscape of the Mobile Payment Technology Market, exploring its growth drivers, market dynamics, key segments, regional analysis, and competitive landscape.

Global Market Overview

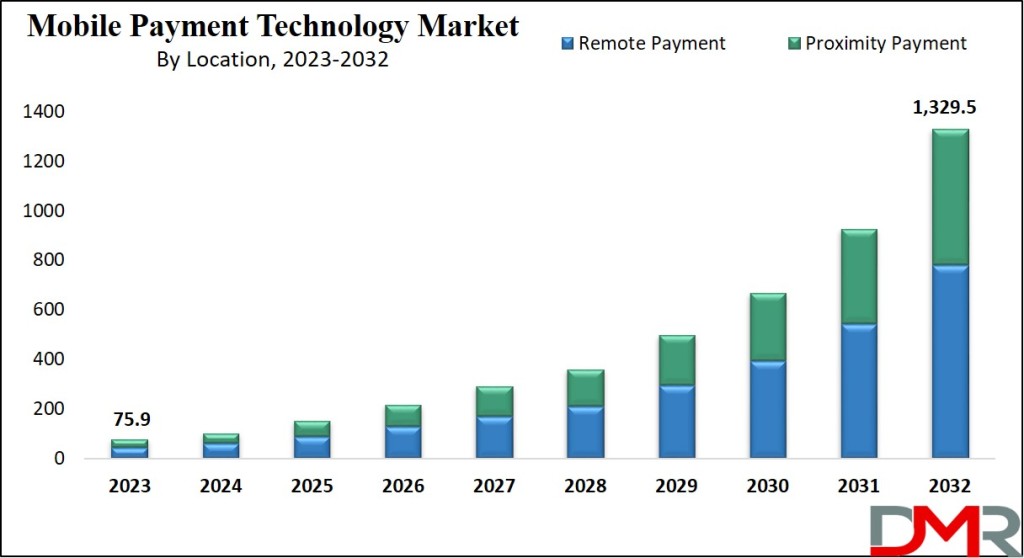

The Global Mobile Payment Technology Market is on an upward trajectory, poised to reach a value of USD 75.9 billion in 2023, with further projections soaring to USD 1,329.5 billion by 2032 at an impressive CAGR of 37.5%. This exponential growth underscores the rising demand for mobile payment solutions worldwide, fueled by advancements in technology and shifting consumer preferences.

Get a Free PDF Sample Copy of this Report@ https://dimensionmarketresearch.com/report/mobile-payment-technology-market/request-sample/

Understanding Mobile Payment Technology

Mobile payment technologies encompass a diverse array of solutions enabling individuals to conduct financial transactions through their mobile devices. From mobile wallets and banking apps to contactless payments and other mobile-based applications, these technologies offer a seamless and secure way for users to make payments using smartphones and tablets.

Market Dynamic: Driving Forces

The global proliferation of smartphones has emerged as a driving force behind the growth of the mobile payment technologies market. With a larger population owning smartphones, the potential user base for mobile payment solutions has expanded significantly. Additionally, the surge in e-commerce and m-commerce activities has further propelled the demand for mobile payment technologies. As consumers increasingly turn to their smartphones for online shopping, mobile payments offer a convenient and reliable alternative to traditional payment methods.

However, widespread adoption of mobile payment technologies hinges upon robust telecommunication infrastructure and stringent security measures. In regions with inadequate network coverage or slow internet speeds, mobile payments may encounter hurdles. Security concerns also pose a challenge, as consumers require assurance that their financial information remains protected from potential breaches or fraud, highlighting the importance of building trust in mobile payment technologies.

Key Takeaways

- The Mobile Payment Technology Market is projected to reach USD 1,329.5 billion by 2032, driven by a CAGR of 37.5%.

- Mobile payment technologies offer a wide range of solutions, including mobile wallets, banking apps, and contactless payments.

- Key growth drivers include the proliferation of smartphones, rise in e-commerce activities, and increasing demand for convenient payment methods.

- Security concerns and the need for robust telecommunication infrastructure are key challenges facing mobile payment adoption.

Key Factors

- Advancements in technology

- Changing consumer preferences

- Security and trust in mobile payment solutions

- Global expansion of smartphones

- Growth of e-commerce and m-commerce activities

Targeted Audience

- Financial institutions

- E-commerce businesses

- Retailers

- Technology companies

- Consumers

Buy this Exclusive Report Here@ https://dimensionmarketresearch.com/checkout/mobile-payment-technology-market/

Research Scope and Analysis

By Technology

Mobile Web Payment

The mobile web payment segment has emerged as a key player, driven by its security and flexibility. With the rising popularity of mobile commerce, these platforms offer a reliable payment solution, enhancing the user experience with user-friendly URLs and seamless transactions.

Near-Field Communication (NFC)

NFC technology is witnessing significant growth, facilitating quick and secure transactions. Integration of NFC-based payment solutions with loyalty programs and coupon redemption mechanisms is driving adoption, further fueled by the rise of e-commerce platforms and wearable payment devices.

By Payment Type

Business-to-Business (B2B)

The B2B segment is experiencing robust growth, fueled by investments from private equity and venture capital firms. Banks are embracing B2B mobile payment solutions to enhance the experience for business clients, driving innovation and growth in this sector.

Business-to-Consumer (B2C)

The B2C segment is witnessing exponential growth, fueled by the proliferation of mobile commerce. With mobile users accounting for a significant portion of e-commerce traffic worldwide, the adoption of digital wallets is expected to drive further growth in this segment.

Mobile Payment Technology: FAQs

1. What are the primary drivers of growth in the mobile payment technology market?

- The proliferation of smartphones, rise in e-commerce activities, and the convenience offered by mobile payments are key growth drivers.

2. How secure are mobile payment technologies?

- Mobile payment technologies employ robust security measures to safeguard user information, including encryption and authentication protocols.

3. What role does NFC technology play in mobile payments?

- NFC technology enables quick and secure transactions, facilitating seamless integration with loyalty programs and enhancing the overall user experience.

4. What are the challenges facing mobile payment adoption?

- Challenges include inadequate telecommunication infrastructure, security concerns, and the need to build consumer trust in mobile payment technologies.

5. How are businesses leveraging mobile payment solutions?

- Businesses are embracing mobile payment solutions to enhance customer experience, streamline transactions, and tap into new revenue streams.

Conclusion

The Mobile Payment Technology Market is witnessing unprecedented growth, propelled by advancements in technology, changing consumer preferences, and the widespread adoption of smartphones. As the market continues to evolve, businesses and consumers alike stand to benefit from the convenience, security, and efficiency offered by mobile payment solutions.

Discover our reports on leading platforms.

Edge Computing Market on Globenewswire

Comments (0)