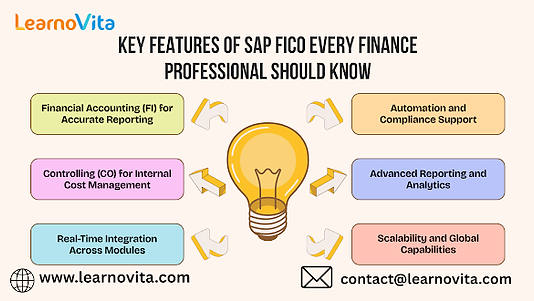

In today’s fast-moving business world, finance professionals are expected to provide more than accurate bookkeeping. They must deliver strategic insights, maintain compliance, and support data-driven decisions. SAP FICO Course in Bangalore is a robust solution designed to meet these demands. As a core module of SAP ERF, SAP FICO integrates financial management with operational processes, enabling organizations to maintain accuracy, efficiency, and transparency. For finance professionals, mastering its key features is essential for long-term success.

1. Financial Accounting (FI): The Core of Financial Reporting

The Financial Accounting (FI) module is responsible for recording financial transactions and generating external reports. It ensures compliance with accounting standards and supports accurate financial statement preparation.

Its major components include:

-

General Ledger (GL): Consolidates all accounting transactions and enables real-time financial reporting.

-

Accounts Payable (AP): Manages vendor invoices, payments, and outstanding liabilities.

-

Accounts Receivable (AR): Tracks customer invoices and incoming payments.

-

Asset Accounting (AA): Oversees fixed assets, depreciation, and asset lifecycle events.

-

Bank Accounting: Facilitates smooth bank reconciliation and effective cash management.

These functions form the foundation of a transparent and reliable financial system.

2. Controlling (CO): Strengthening Internal Cost Management

While FI focuses on statutory reporting, the Controlling (CO) module provides insights into internal financial performance. It enables organizations to analyze costs, monitor budgets, and evaluate profitability.

Key features include:

-

Cost Center Accounting: Tracks expenses across departments and business units.

-

Profit Center Accounting: Measures performance and profitability by segment.

-

Internal Orders: Monitors project-based or temporary expenditures.

-

Product Costing: Calculates production costs to guide pricing strategies.

-

Profitability Analysis (COPA): Assesses revenue and margin performance across markets and products.

With these tools, finance professionals can actively contribute to business strategy.

3. Real-Time Integration Across Business Functions

A major advantage of SAP FICO is its seamless integration with other modules such as sales, procurement, and inventory management. Financial data is automatically updated whenever operational transactions occur. For example, sales activities immediately impact revenue and receivable accounts, while procurement processes update expense and liability accounts. This integration reduces duplication, enhances accuracy, and improves overall efficiency.

4. Automation of Financial Processes

SAP FICO enhances productivity by automating routine financial tasks. Recurring journal entries, payment runs, tax calculations, and foreign currency adjustments can be processed efficiently within the system. Automation reduces Software Training Institute manual errors and allows finance teams to focus on forecasting, analysis, and strategic planning.

5. Advanced Reporting and Real-Time Analytics

Reliable reporting is essential for informed decision-making. SAP FICO offers comprehensive financial reports, including balance sheets, income statements, and cash flow analyses. With advanced innovations like SAP S/4HANA, organizations gain access to real-time dashboards and powerful analytics capabilities. These features provide immediate visibility into financial performance and support proactive management.

6. Scalability and Global Capabilities

SAP FICO is designed to support organizations of all sizes, from mid-sized enterprises to multinational corporations. It accommodates multiple currencies, diverse tax regulations, and country-specific compliance requirements. As businesses expand into global markets, SAP FICO adapts seamlessly, ensuring consistent and efficient financial operations.

Conclusion

SAP FICO is a comprehensive financial management solution that combines accounting accuracy, cost control, automation, and analytics in one integrated platform. For finance professionals, understanding its key features enhances operational efficiency and strengthens strategic impact. In today’s competitive business environment, SAP FICO expertise is not just valuable it is essential for sustained professional growth and organizational success.

Comments (0)