The Metals Company is chasing a multibillion-dollar prize at the bottom of the Pacific Ocean. Here's what you should know about this deep-sea miner.

When you think of a mining company, you might think of something like this: giant yellow trucks crawling in and out of an pit, drills breaking up rock in the earth, maybe a long conveyor belt or dump truck transporting ore to a processing plant.

TMC The Metals Company (TMC 9.90%), however, looks nothing like that typical picture.

Today's Change

(-9.90%) $-0.73

Current Price

$6.64

Instead, the picture for TMC is more like this: a ship out in the Pacific Ocean, vacuuming rocks off the seabed with a vehicle that looks it could have auditioned for Wall-E.

Image source: The Metals Company.

As a frontrunner in the deep-sea mining space, TMC could offer a cheaper and less disruptive way to extract critical minerals. At the same time, the company is pre-revenue and faces regulatory hurdles, which is why it's worth taking a closer look at what the company is trying to do before investing.

What TMC is trying to buildTMC's entire business is tied to polymetallic nodules in the Clarion-Clipperton Zone, a region of the Pacific Ocean that holds billions of these lumpy potato-sized rocks. Each nodule is essentially an electric car battery in composite form, as they contain nickel, copper, cobalt, and manganese.

In a nutshell, the company wants to mine these nodules robotically by vacuuming them off the seafloor of the Pacific Ocean. It will then process them into battery-grade metals and sell them into supply chains.

It's a bold idea. And it has some early support. Korea Zinc, a non-ferrous metal refiner, recently invested about $85 million in the company, while Allseas, an offshore engineering specialist, converted a drillship into a deep-sea mining vessel.

As far as opportunity goes, TMC could be sitting on a treasure chest worth billions. Its latest economic study, for example, points to a project value of $23.6 billion, which dwarfs its current market valuation of about $3.2 billion.

What's stopping the company from commercializationAlthough it might be sitting on a multibillion-dollar nodule reserve, TMC does not have regulatory approval to mine those rocks commercially.

Not only that, but the regulatory process for deep-sea mining is still an enigma. The International Seabed Authority (ISA), which governs mining in international waters, has not finalized its rulebook, and debate over the environmental risks of deep-sea mining has muddled the timeline for when companies like TMC can apply for a commercial license.

Despite this impasse, TMC is pursuing a parallel path through the U.S. It can do so because the U.S. has not ratified the treaty that created the ISA. Because of this, TMC could potentially secure the U.S.'s blessing to move forward with operations, although any move outside the ISA could face significant political pushback.

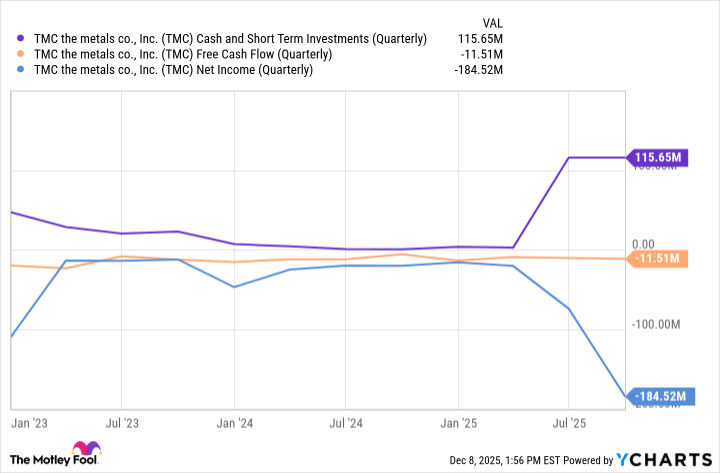

Financially, TMC is currently losing money and could do so for several years. Its third-quarter net loss was about $184.5 million, or $0.46 per share. It had approximately $165 million in total liquidity, which provides it with some cushion to operate without generating significant revenue.

TMC Cash and Short Term Investments (Quarterly) data by YCharts.

As such, the metal stock is a speculative play on the future of metal scarcity. Size positions carefully, as it's not clear yet when the company will obtain the key for its treasure chest of nodules.